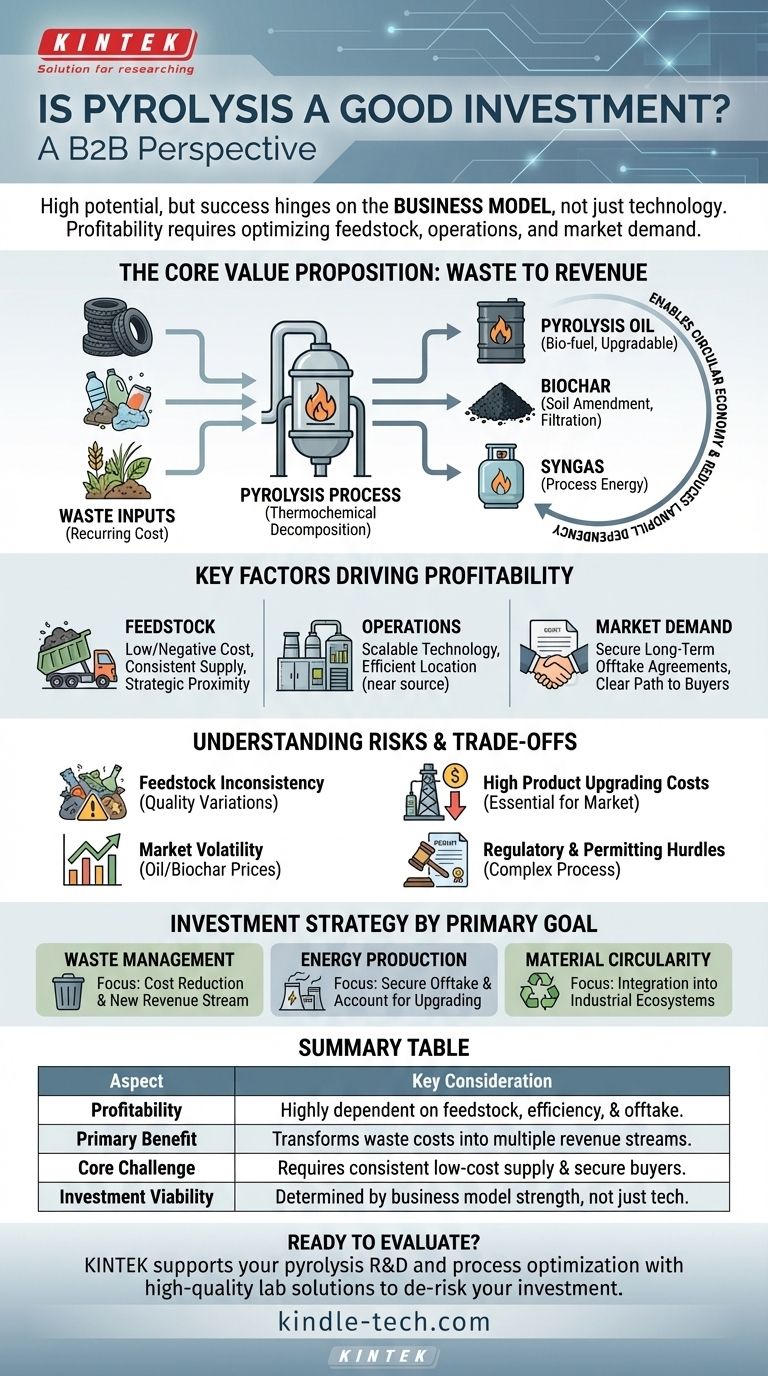

As an investment, pyrolysis can be highly profitable, but its success is not guaranteed by the technology alone. It offers a proven method for converting waste materials like plastics, tires, and biomass into valuable commodities such as fuel and chemicals, directly addressing waste management costs while creating new revenue streams. However, profitability hinges entirely on specific operational and market conditions.

The investment viability of a pyrolysis project is determined less by the core technology and more by the strength of its business model—specifically, the cost and consistency of its feedstock supply, its operational efficiency, and the existence of secure, long-term buyers for its end products.

The Core Value Proposition: Turning Waste into Revenue

Pyrolysis is fundamentally a thermochemical decomposition process. Organic material is heated in the absence of oxygen, breaking it down into smaller, more valuable molecules rather than simply burning it.

Reducing Landfill Dependency

For many businesses and municipalities, waste is a significant operational cost. Tipping fees for landfills are a direct expense.

By diverting waste streams—such as agricultural residue, end-of-life plastics, or used tires—to a pyrolysis plant, an organization can transform a recurring cost into a source of raw material for a revenue-generating process.

Creating Marketable Products

The process yields three primary products, each with potential markets:

- Pyrolysis Oil (Bio-oil): A liquid fuel that can be used for boilers and furnaces or be upgraded into higher-grade fuels like diesel.

- Biochar (or Carbon Black): A stable, carbon-rich solid. It can be used as a soil amendment in agriculture, a filtration medium, or as a component in manufacturing.

- Syngas: A mixture of combustible gases that is typically used on-site to provide the energy needed to power the pyrolysis process itself, reducing external energy costs.

Enabling a Circular Economy

Pyrolysis is a key technology for resource circularity. It enables the recovery of the chemical building blocks locked within waste plastics and other materials.

This reduces the demand for virgin raw materials, such as crude oil, lowering the overall environmental footprint and creating a more sustainable production lifecycle.

Key Factors Driving Profitability

A successful pyrolysis plant operates like any other refinery or chemical plant. Success is a function of managing inputs, outputs, and operational efficiency.

Feedstock Availability and Cost

This is the single most critical factor. The ideal scenario is a consistent, long-term supply of low-cost or even negative-cost feedstock (i.e., you are paid to take the waste).

Proximity to sources like large agricultural operations, municipal solid waste facilities, or tire recycling centers is a major strategic advantage, as it minimizes transportation costs.

Operational Scale and Location

Pyrolysis technology is flexible. It can be deployed in large, centralized facilities or in smaller, modular units located in remote areas.

This allows the plant to be sited directly where the waste is generated, significantly cutting down on the cost of transporting bulky raw materials like biomass. It effectively densifies the energy and makes it cheaper to move the resulting liquid product.

Offtake Agreements and Market Demand

Your products are only valuable if someone is willing to buy them. Before a single dollar is invested, you must have a clear path to market for your pyrolysis oil and biochar.

Secure, long-term offtake agreements with buyers (e.g., refineries, chemical plants, agricultural distributors) are essential for de-risking the investment and securing financing. Without them, you are exposed to commodity price volatility.

Understanding the Trade-offs and Risks

While the potential is clear, pyrolysis is not without significant challenges that must be factored into any investment analysis.

The Feedstock Challenge

Consistency is as important as cost. Variations in the moisture content, chemical composition, or contamination of your feedstock can drastically affect the efficiency of the process and the quality of your end products. A plant optimized for wood chips will not run well on mixed plastic waste.

High Product Upgrading Costs

Pyrolysis oil is not a direct replacement for crude oil. It is typically acidic, corrosive, and chemically unstable.

It almost always requires significant and costly hydrotreating or other upgrading processes before it can be sold to a conventional refinery. This "back-end" cost is a critical and often underestimated part of the business model.

Market Volatility for End Products

The value of pyrolysis oil is often benchmarked against the fluctuating price of crude oil. Similarly, the market for biochar is still maturing in many regions. Your financial model must be resilient enough to withstand this commodity price risk.

Regulatory and Permitting Hurdles

A pyrolysis plant is a chemical processing facility that handles waste. As such, it is subject to stringent environmental regulations and a complex, often lengthy, permitting process. These represent significant upfront costs and project timeline risks.

Making the Right Investment Decision

Your investment strategy should be dictated by your primary goal.

- If your primary focus is waste management: Pyrolysis is a strong option to reduce landfill costs and create a new revenue stream, provided you have secured a consistent, low-cost feedstock supply.

- If your primary focus is profitable energy production: The investment is only viable if you have secured long-term offtake agreements and fully accounted for the mandatory costs of upgrading the raw pyrolysis oil to meet buyer specifications.

- If your primary focus is material circularity (e.g., advanced plastics recycling): Pyrolysis is a leading technology, but success often requires integration into a larger industrial ecosystem where the recovered chemical feedstocks can be purified and used.

A successful pyrolysis investment is built not on technology alone, but on a meticulously planned and de-risked business model.

Summary Table:

| Aspect | Key Consideration |

|---|---|

| Profitability | Highly dependent on feedstock cost, operational efficiency, and offtake agreements. |

| Primary Benefit | Transforms waste management costs into revenue streams (oil, biochar, syngas). |

| Core Challenge | Requires a consistent, low-cost feedstock supply and secure buyers for end products. |

| Investment Viability | Determined by the strength of the business model, not just the technology. |

Ready to evaluate if pyrolysis is the right investment for your operation?

At KINTEK, we specialize in providing the high-quality lab equipment and consumables necessary for pyrolysis R&D and process optimization. Whether you are testing feedstock, analyzing bio-oil, or scaling your process, our reliable solutions help you de-risk your investment and maximize returns.

Contact us today via our [#ContactForm] to discuss how KINTEK can support your laboratory's role in building a profitable and sustainable pyrolysis business model.

Visual Guide

Related Products

- Electric Rotary Kiln Small Rotary Furnace Biomass Pyrolysis Plant

- Electric Rotary Kiln Continuous Working Small Rotary Furnace Heating Pyrolysis Plant

- 1700℃ Laboratory High Temperature Tube Furnace with Alumina Tube

- Quartz Electrolytic Electrochemical Cell for Electrochemical Experiments

- Customizable PEM Electrolysis Cells for Diverse Research Applications

People Also Ask

- What are the disadvantages of the Austempering process? Key Limitations and Trade-offs

- Why are high-precision constant temperature shakers essential for PCB degradation? Ensure Precise Research Results

- What is solid state sintering? A Guide to High-Purity Material Consolidation

- What is the sintering process of coating? Building Durable, Solid Layers from Powder

- Why is the melting point different for different substances? The Key Role of Bond Strength

- What is the source of bio-oil? Unlock Renewable Energy from Biomass

- Does THC distillate lose potency? A guide to preserving your product's power.

- Why is potassium bromide used in FTIR? The Key to Accurate Solid Sample Analysis