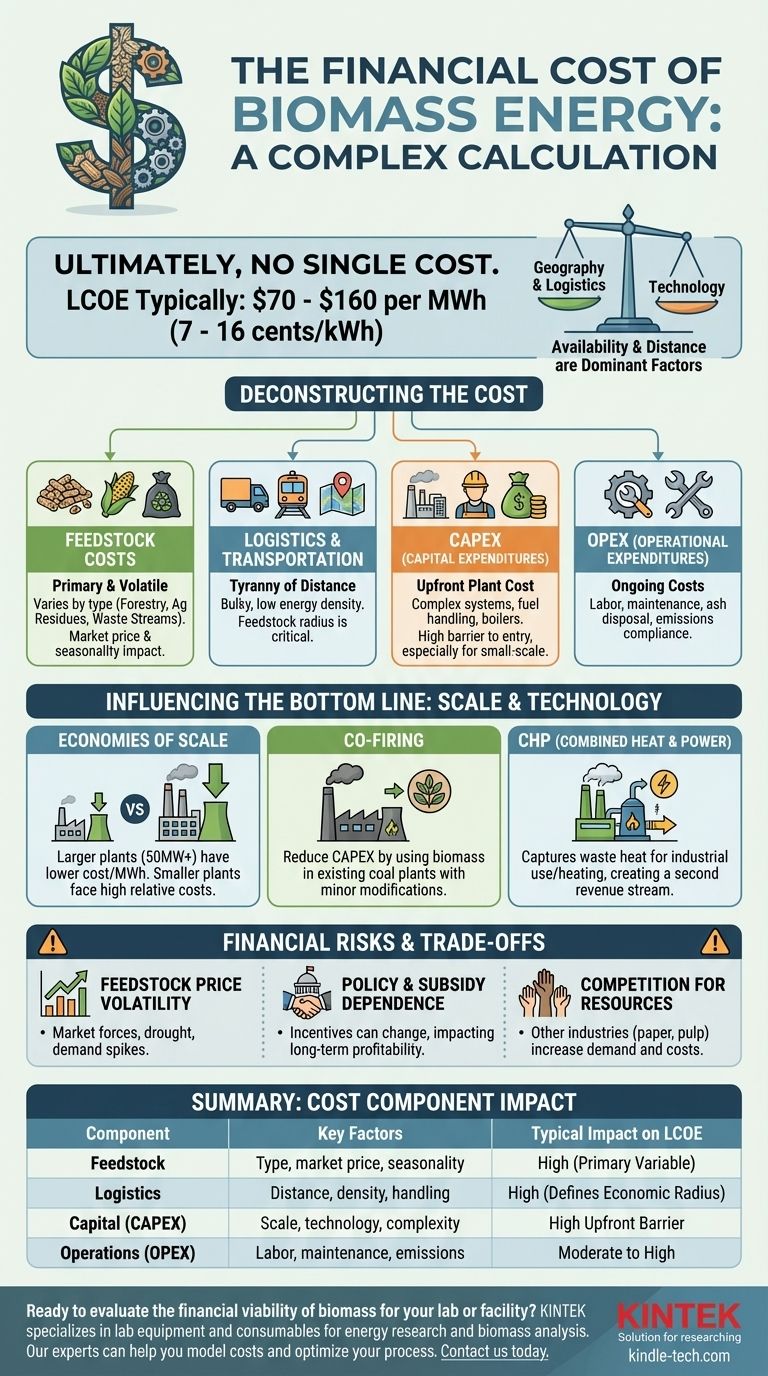

Ultimately, there is no single financial cost for biomass energy. The cost is a complex calculation that varies dramatically based on the type of fuel used, transportation distance, and the scale of the power plant. For electricity generation, the unsubsidized Levelized Cost of Energy (LCOE) for biomass typically falls between $70 and $160 per megawatt-hour (MWh), which translates to 7 to 16 cents per kilowatt-hour (kWh).

The financial viability of a biomass project is rarely determined by the technology itself, but by the project's specific geography and logistics. The availability of a cheap, reliable feedstock and the distance it must travel are the two most dominant factors in its overall cost.

Deconstructing the Cost of Biomass Energy

To understand the total cost, you must break it down into its core components. The final price is a sum of feedstock, logistics, capital investment, and ongoing operations.

Feedstock Costs: The Primary Variable

The "fuel" for a biomass plant is its single largest and most volatile operating expense. Costs depend entirely on what you burn.

- Forestry Products: Wood pellets are a common, energy-dense fuel, but they are a manufactured product with a market price that can fluctuate significantly.

- Agricultural Residues: Using materials like corn stover or sugarcane bagasse can be very inexpensive, but their availability is seasonal and dependent on agricultural markets.

- Waste Streams: Municipal solid waste (MSW) or industrial waste can have a negative cost (you get paid to take it), but this requires significant pre-processing to separate combustibles, which adds expense.

Logistics and Transportation: The Tyranny of Distance

Biomass is bulky and has a low energy density compared to fossil fuels. This means transportation is a major logistical and financial challenge.

A power plant's profitability is often defined by its "feedstock radius"—the maximum distance from which it can economically source fuel. This can be as little as 50 miles, and exceeding it can quickly render a project unprofitable.

Capital Expenditures (CAPEX): The Cost of the Plant

This is the upfront cost to build the facility. Biomass plants are mechanically complex, requiring systems for fuel handling, storage, combustion (boilers), steam turbines, and emissions control.

A new, dedicated biomass plant has a significant capital cost, often higher per megawatt than a natural gas plant. This cost is a major barrier to entry, especially for smaller-scale projects.

Operational Expenditures (OPEX): Keeping the Plant Running

Beyond fuel, a biomass plant has ongoing costs for labor, routine maintenance of mechanical systems, ash disposal, and compliance with environmental regulations. These are generally more intensive than for a comparable solar or wind facility.

How Scale and Technology Influence the Bottom Line

The size of the plant and the technology it employs create different financial profiles. One size does not fit all, and the right choice depends on the available feedstock and local energy needs.

The Economies of Scale

Like most power generation, biomass benefits from economies of scale. Large, utility-scale plants (over 50 MW) can produce electricity at a much lower cost per MWh than smaller, community-scale systems. Smaller plants face disproportionately high capital and operational costs relative to their output.

Co-firing and Repurposing

A common strategy to reduce high upfront capital costs is to co-fire biomass in an existing coal-fired power plant. By replacing a portion of the coal with biomass, a utility can produce renewable energy with only minor modifications to the plant, drastically reducing CAPEX.

Combined Heat and Power (CHP)

Biomass is particularly well-suited for Combined Heat and Power (CHP) applications. These plants capture the "waste" heat from the electricity generation process and sell it for industrial processes or district heating. This creates a second, valuable revenue stream, significantly improving the project's overall financial picture.

Understanding the Trade-offs and Financial Risks

Unlike wind and solar, where the fuel is free, biomass economics are subject to market forces and supply chain risks that must be carefully managed.

Feedstock Price Volatility

The price of biomass feedstock is not fixed. A drought could impact agricultural residues, or a boom in home construction could increase demand for wood, driving up prices for wood pellets. This fuel price risk is a primary concern for investors.

Policy and Subsidy Dependence

Many biomass projects are only financially viable due to government incentives. This can include renewable energy credits, tax breaks, or carbon pricing schemes. A change in political winds or policy can eliminate these subsidies, posing a significant risk to the long-term profitability of a plant.

Competition for Resources

The material used for biomass energy is often in demand by other industries. Wood is needed for paper, pulp, and building materials. Agricultural residues may be used for animal bedding or improving soil health. This competition can limit supply and increase costs.

Calculating the True Cost for Your Project

To determine if biomass is a viable option, shift your focus from a universal price to a local analysis of your specific conditions and goals.

- If your primary focus is utility-scale power generation: Your success hinges on securing long-term, fixed-price feedstock contracts and siting the plant strategically to minimize transport costs.

- If your primary focus is industrial decarbonization: Evaluate using your own industrial or agricultural waste streams in a CHP plant to generate both heat and power, maximizing value.

- If your primary focus is small-scale community energy: Prioritize hyper-local feedstocks like municipal solid waste or forestry maintenance thinnings, as high capital costs and logistics will be your biggest financial hurdles.

Ultimately, the financial viability of biomass is unlocked through a rigorous analysis of your local resources and supply chain, not by finding a single number.

Summary Table:

| Cost Component | Key Factors | Typical Impact on LCOE |

|---|---|---|

| Feedstock | Type (wood, waste, residues), market price, seasonality | High (primary variable) |

| Logistics | Transportation distance, fuel density, handling | High (defines economic radius) |

| Capital (CAPEX) | Plant scale, technology (CHP, co-firing), complexity | High upfront barrier |

| Operations (OPEX) | Labor, maintenance, emissions control, ash disposal | Moderate to high |

Ready to evaluate the financial viability of biomass for your lab or facility? KINTEK specializes in lab equipment and consumables for energy research and biomass analysis. Our experts can help you model costs, select the right analytical tools, and optimize your process—ensuring you make data-driven decisions. Contact us today to discuss your project needs!

Visual Guide

Related Products

- Electric Rotary Kiln Small Rotary Furnace Biomass Pyrolysis Plant

- Electric Rotary Kiln Continuous Working Small Rotary Furnace Heating Pyrolysis Plant

- Electric Rotary Kiln Small Rotary Furnace for Activated Carbon Regeneration

- Laboratory Manual Hydraulic Pellet Press for Lab Use

- Electric Rotary Kiln Pyrolysis Furnace Plant Machine Calciner Small Rotary Kiln Rotating Furnace

People Also Ask

- What is the process of biomass fast pyrolysis? Turn Biomass into Bio-Oil in Seconds

- What are the conditions for biomass pyrolysis? Optimize Temperature, Heating Rate & Time

- Is pyrolysis viable? A Guide to Economic, Technological, and Environmental Success

- What are the advantages of pyrolysis technology? Turn Waste into Profit and Reduce Emissions

- What are the different types of pyrolysis machines? Choose the Right System for Your Output