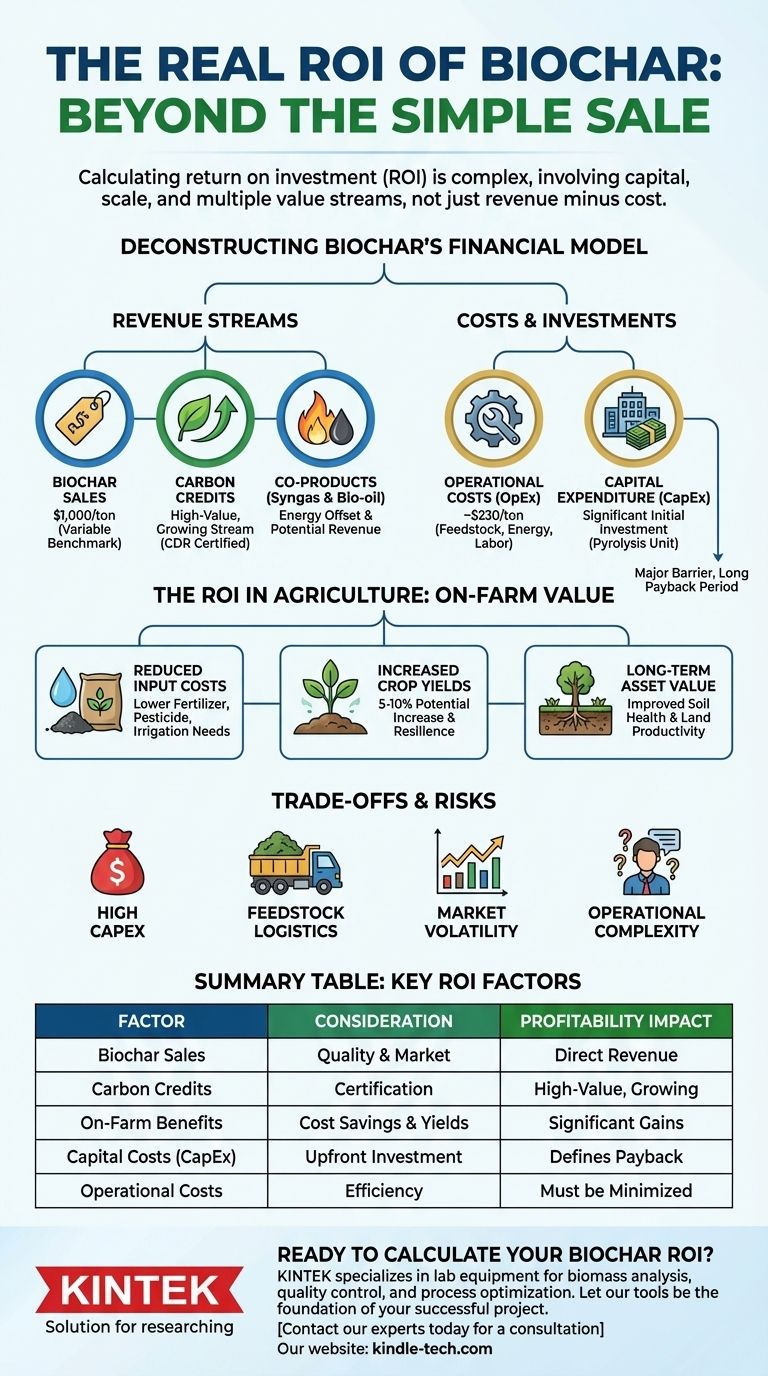

Calculating the return on investment (ROI) for biochar is not a simple matter of revenue minus cost. A basic calculation using a market price of $1,000 per ton and a production cost of $230 per ton suggests a high profit margin. However, this simple view is misleading. A true ROI calculation must account for significant initial capital investment, the scale of production, and crucially, multiple value streams beyond the sale of the physical product.

The financial viability of biochar rarely comes from selling the char alone. The true return on investment is a complex equation factoring in reduced farm inputs, increased crop yields, and the rapidly growing revenue stream from certified carbon removal credits.

Deconstructing Biochar's Financial Model

To understand the real ROI, we must break down the financial components beyond the simple price and cost figures. The business case for biochar is a system of interconnected costs and revenues.

The Core Revenue: Biochar Sales

The often-quoted price of $1,000 per ton is a useful benchmark but is highly variable. The actual price you can command depends on quality, particle size, local demand, and your target market. Agricultural users may pay less than specialized industrial or environmental remediation clients.

Production Costs: Operational vs. Capital

The estimated $230 per ton production cost likely refers only to operational expenses—the cost of feedstock, energy, and labor to run the machine. This figure crucially omits the largest financial hurdle: the initial Capital Expenditure (CapEx) for the pyrolysis equipment, which can range from tens of thousands to millions of dollars.

The Hidden Revenue Stream: Carbon Credits

This is the most dynamic and potentially lucrative factor in biochar's ROI. Because biochar production is a method of carbon dioxide removal (CDR), each ton can be certified to generate carbon credits. These credits are sold on voluntary markets to corporations seeking to offset their emissions, sometimes generating revenue equal to or greater than the biochar itself.

Valuing the Co-products: Syngas and Bio-oil

Pyrolysis doesn't just create char; it also produces syngas (synthetic gas) and bio-oil. These energy-rich co-products can be used to power the pyrolysis unit itself, drastically reducing energy costs. In larger systems, they can be captured and used to generate electricity or heat for other processes, creating an additional revenue stream or cost offset.

The ROI in Agriculture: Beyond Direct Sales

For farmers or land managers, the ROI calculation shifts from a sales model to a cost-savings and productivity model. Here, the value is realized on the farm over several years.

Reduced Input Costs

Biochar's high porosity and stability significantly improve soil's water and nutrient retention. This translates directly into a quantifiable financial saving through reduced fertilizer, pesticide, and irrigation needs. This cost avoidance is a primary driver of on-farm ROI.

Increased Crop Yields

By improving soil structure, water availability, and microbial health, biochar can lead to more resilient crops and higher yields. While this effect varies by soil type and crop, even a modest, consistent yield increase of 5-10% represents a significant annual return.

Long-Term Asset Value

Applying biochar is an investment in the long-term health and resilience of your soil. This improves the fundamental asset value of the land, making it more productive and resistant to drought and environmental stress for decades to come.

Understanding the Trade-offs and Risks

A clear-eyed assessment requires acknowledging the significant hurdles that impact the return on investment.

High Initial Capital Expenditure (CapEx)

The upfront cost of a pyrolysis unit is the single biggest barrier. This initial investment can mean a payback period of several years, even with strong revenue streams. Financing this capital is a primary challenge for new producers.

Feedstock Logistics and Cost

Biochar production requires a consistent, low-cost supply of dry biomass (e.g., wood chips, crop residues, manure). Sourcing, transporting, and preparing this feedstock is a major operational cost and logistical challenge that can heavily influence profitability.

Market and Price Volatility

The markets for both biochar and carbon credits are relatively new and can be volatile. While the trend is positive, there are no long-term price guarantees. Relying on a single price point for a long-term financial projection is risky.

Operational Complexity and Scale

Running a pyrolysis unit efficiently requires technical expertise. The economics also change dramatically with scale. Small, on-farm units have a different ROI calculation (focused on soil benefits) than large, industrial facilities (focused on carbon credits and char sales).

How to Calculate Your Potential ROI

To determine if biochar is a sound investment for you, your calculation must be tailored to your specific goal.

- If your primary focus is selling biochar commercially: Your ROI hinges on securing low-cost feedstock, maximizing operational efficiency, and gaining access to high-value markets and carbon credit programs.

- If your primary focus is on-farm use: Your ROI is primarily measured by reduced fertilizer/water costs and increased crop yields over several seasons, not just the sale price of the char.

- If your primary focus is environmental impact and carbon removal: Your financial return is directly tied to the certification and sale of carbon removal credits, which may require significant upfront investment in monitoring and verification.

A true assessment of biochar's value requires looking beyond a simple sales margin to a holistic view of its financial and ecological impact on your specific system.

Summary Table:

| ROI Factor | Key Consideration | Impact on Profitability |

|---|---|---|

| Biochar Sales | Price varies by quality & market ($1,000/ton is a benchmark) | Direct revenue stream |

| Carbon Credits | Certified carbon removal credits can match or exceed biochar revenue | High-value, growing revenue stream |

| On-Farm Benefits | Reduced fertilizer/water needs & 5-10% yield increases | Significant cost savings & productivity gains |

| Capital Costs (CapEx) | Pyrolysis unit is a major upfront investment | Defines payback period; financing is key |

| Operational Costs | Feedstock, energy, labor (~$230/ton) | Must be minimized for profitability |

Ready to Calculate Your Biochar ROI?

Navigating the complex financial model of biochar production requires expertise. KINTEK specializes in lab equipment and consumables for analyzing biomass, biochar quality, and pyrolysis processes, serving the precise needs of laboratories and research facilities developing biochar solutions.

We provide the analytical tools you need to:

- Accurately characterize feedstock and final biochar product.

- Optimize pyrolysis conditions for maximum efficiency.

- Validate data for carbon credit certification.

Let KINTEK's equipment be the foundation of your successful biochar project. Contact our experts today for a consultation tailored to your laboratory's requirements.

Visual Guide

Related Products

- Laboratory Sterilizer Lab Autoclave Herbal Powder Sterilization Machine for Plant

- Twin Screw Extruder Plastic Granulation Machine

- Powerful Plastic Crusher Machine

- Lab Plastic PVC Calender Stretch Film Casting Machine for Film Testing

- Mini Planetary Ball Mill Machine for Laboratory Milling

People Also Ask

- What is the necessity of using a steam autoclave for dental alloys? Ensure Pure Bacterial Adhesion Data

- What are the standard operating parameters for an autoclave? Master Temperature, Pressure, and Time for Sterilization

- How should solid materials in bags be prepared for decontamination? Master Steam Penetration for Safe Sterilization

- Why is the prevention of air entrapment critical for the autoclave sterilization process? Ensure 100% Sterility Today

- What role does an autoclave play in remediation experiments? Ensure Precision by Eliminating Biological Noise